when can life insurance be denied

21 Death due to suicide. So yes life insurance.

How To Win When Intoxication Exclusions In Life Insurance Or Accidental Death And Dismemberment Insurance Policies Are Abused By Insurance Companies Like Cigna A K A Life Insurance Company Of North America Law

Consider appealing the decision.

. 485 3 votes Quickly put a life insurance claim can be paid denied or delayed. Insurers deny the death benefit on life insurance claims for reasons of policy delinquency material misrepresentation. Life insurers may contest and deny a claim if death occurred due to suicide within the two-year constability period.

Reasons for Denial of Life Insurance Plan. If you have a life insurance payout that has been denied after the contestability period you can talk to a life insurance lawyer at Boonswang Law free of charge. Yes a life insurance company may deny you coverage if you are overweight.

The death happened during the contestability period. You could be denied traditional life insurance for several reasons. If you intentionally leave out anything the insurance company needs to know on your application or during the phone interview the.

Very often however life insurance claims get denied for a variety of reasons. Here are some of the most typical explanations for why your application for life insurance can be denied. Quickly put a life insurance claim can be paid denied or delayed.

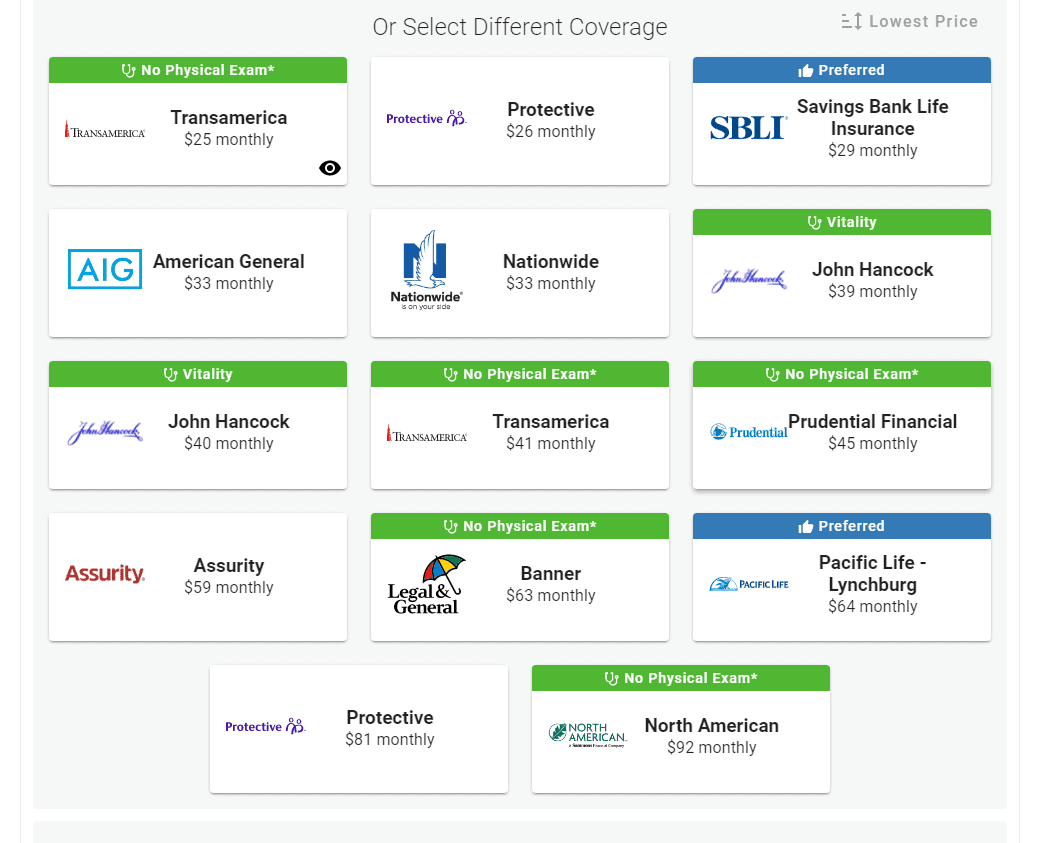

It is important to select an insurance carrier with a lenient policy towards build requirements which is your height to weight ratio. In most cases the insurance company will deny a claim if the death was not accidental or if the policyholder did not follow the proper procedures for filing a claim. Appeal the rejection.

Your life insurance application could potentially be rejected because of your mental illness. Figure Out Why You Were Denied Life Insurance. So yes life insurance companies can deny claims and refuse to pay out and if youre here chances are.

Life insurance claims are often denied by insurers for a wide variety of reasons some of which are quite reasonable such as unpaid premiums or early suicide and others which are less so. This could mean providing incorrect. Can Life Insurance Be Denied If You Have A Mental Illness.

If you feel you have a solid case and want to appeal your denied life insurance claim you can. Lying or withholding information. Jul 27 2022 What can.

Yes your claim for life insurance can be denied for different reasons. Call us today at 1-855-865. Along with the suicide.

Reasons why life insurance claims are denied. Below are some possible. Contest the decision with the insurer directly most.

The most common reason is that you made an inappropriate claim. Heres what you can do if your life insurance application has been rejected. However because every life insurance company will have its own rules regarding weight limits it is possible to.

If youre denied life insurance on the basis of incorrect or insufficient information you have the right to appeal the. Policies have contestability periods that. Here are four things that can lead to the denial of a life insurance claim.

What To Do When You Re Denied For Life Insurance Jrc Insurance Group

What To Do If Your Life Insurance Claim Is Denied South Florida Reporter

The Denial Of Death Benefits Life Insurance Claim Denied

Life Insurance Claim Denied What Are My Legal Options

What To Do If You Re Denied Life Insurance Ramsey

11 Reasons You Were Declined For Life Insurance Jrc Insurance Group

Life Insurance With A Felony Justburyme

3 Reasons Why Your Insurance Claim Denied Protective Life

Insurance License Denial The Law Offices Of Lucy S Mcallister

Why Your Life Insurance May Have Been Denied In New York

5 Common Reasons For Denial Of Life Insurance Claims

Denied Life Insurance Here Are Your Next 3 Steps Life Happens

How Long Does Life Insurance Take To Pay Out 2022

5 Surprising Things That Can Prevent You From Getting Life Insurance Fox Business

What To Do When Denied Life Insurance Selectquote

Life Insurance Denied For Naloxone Carriers Health Life Insurance Actuaries Lewis Ellis Inc

How To Reinstate A Life Insurance Policy That You Stopped Paying Forbes Advisor